On November 4, 2020, the Centers for Medicare & Medicaid Services (CMS) published the final rule in the Federal Register for calendar year (CY) 2021 Home Health Prospective Payment System (HH PPS). The rule is effective January 1, 2021.

Each year, CMS publishes updates to the regulations for inflation factors, wage index adjustments, and other patient-care related payment adjustments.

Below is an overview of the CY 2021 HH PPS, including final changes and other relevant updates.

Final Changes for Home Health

CMS has finalized the following updates, payment policies, and payment rates.

Summary of Costs, Transfers, and Benefits

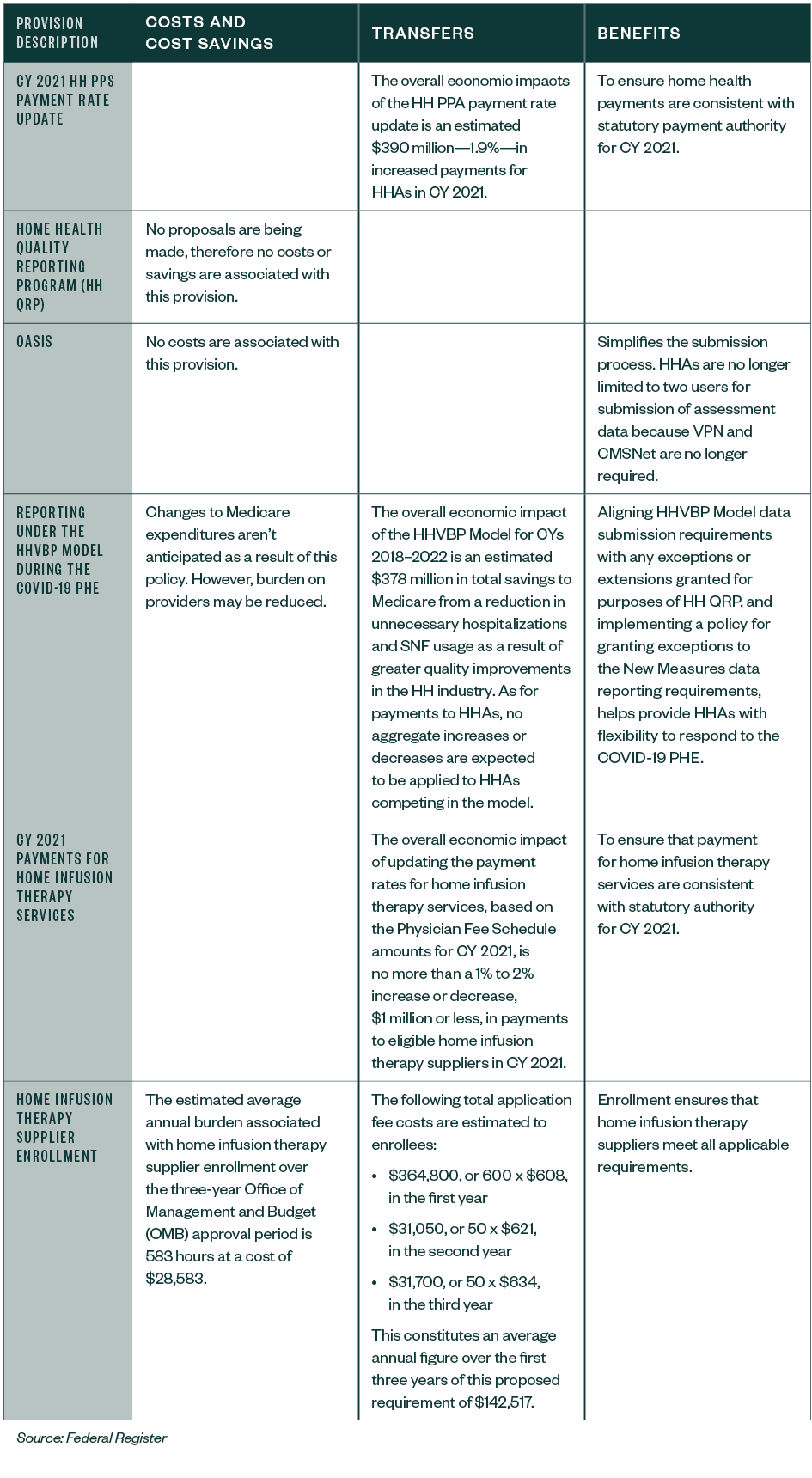

The below table, included by CMS in the final rule, outlines updates for provisions including the payment-rate update, Outcome and Assessment Information Set (OASIS), home infusion therapy services and supplier enrollment, and more.

Table 1: Summary of Costs, Transfers, and Benefits

National Adjusted Standardized Amounts

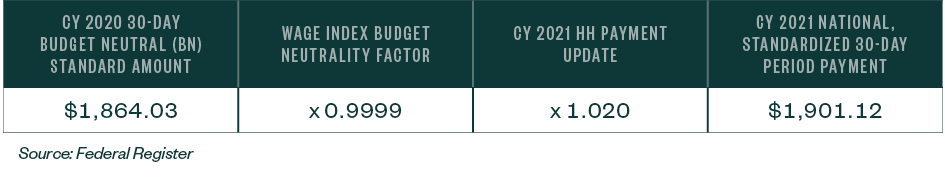

The standardized payment for HHAs will increase 2%.

Table 7: CY 2021 National, Standardized 30-Day Period Payment Amount

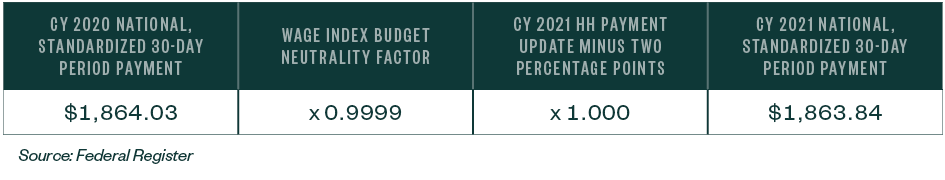

In addition, the home health update has a decrease of two percentage points for those HHAs that don’t submit quality data; therefore, for HHAs that don’t submit the required quality data for CY 2021, the home health payment update will be 0% and the standardized amount will decrease as a result of the wage index budget neutrality factor.

Table 8: CY 2021 National, Standardized 30-Day Period Payment Amount for HHAS that Don’t Submit the Quality Data

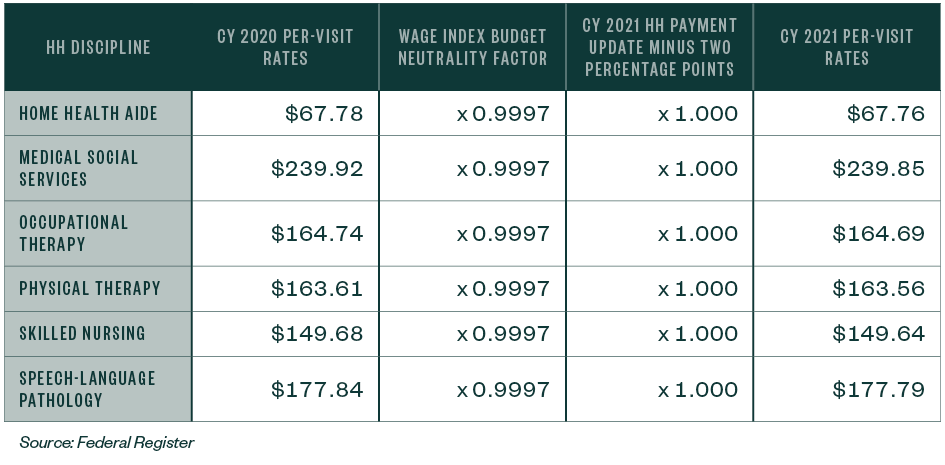

Per Visit Amounts

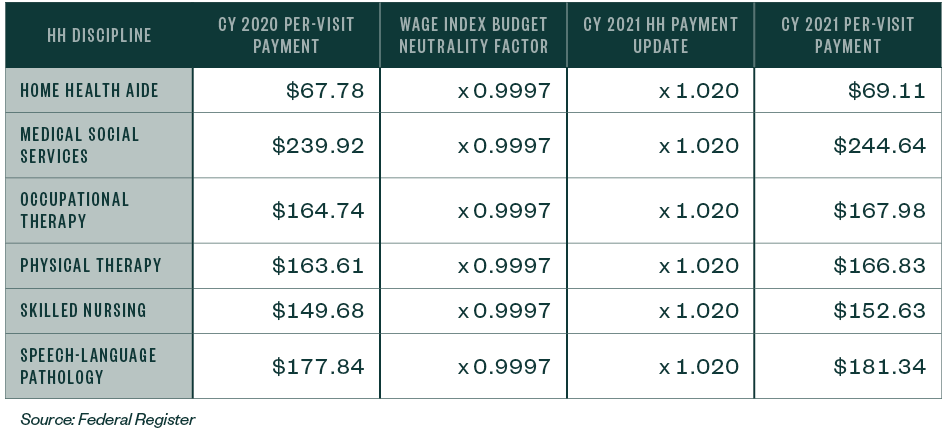

The per visit amounts for HHAs that submit the required quality data will increase 2%.

Table 9: CY 2021 National Per-Visit Payment Amount

The per-visit amounts for HHAs that don’t submit the required quality data will be 0%, and the amount will decrease as a result of the wage index budget neutrality factor.

Table 10: CY 2021 National Per-Visit Payment Amounts for HHAS that Don’t Submit the Required Quality Data

Telehealth

CMS finalized the April 6, 2020, publication which will allow HHAs to continue to utilize telecommunications technology to provide care to beneficiaries beyond the COVID-19 Public Health Emergency Interim Rule (PHE). The care must be a covered Medicare home health benefit.

The requirements will be in effect as long as the telecommunications technology is:

- Related to the skilled services being furnished

- Outlined in the plan of care

- Tied to a specific treatment goal indicating how such use would facilitate treatment outcomes

The use of technology may not be used:

- To substitute an in-person visit required by the patient’s plan of care

- As a visit for eligibility and payment

HHAs may continue to report the cost of telecommunications technology as allowable administrative costs on the HHA cost report beyond the PHE.

Wage Index Updates and Core-Based Statistical Area Designation

CMS finalized a transition with a one-year cap on wage index decreases in excess of 5%, consistent with the policy being adopted for other Medicare payment systems.

CMS finalized as proposed to update the home health wage index including the adoption of revised OMB statistical area delineations and limiting any decreases in a geographic area’s wage index value to no more than 5% in CY 2021.

The following classification changes will occur due to the finalized core-based statistical area (CBSA) revisions:

- 34 counties currently classified as urban will be classified as rural

- 47 rural counties will be reclassified as urban

- Some counties will move from one CBSA to another

Additional Updates

CMS also finalized additional changes, including the proposal to hold the low utilization payment adjustments (LUPA) thresholds and Patient-Driven Groupings Model (PDGM) case mix at the 2020 rates.

Economic Impact

The overall economic impact of this rule is an estimated $390 million in increased payments from the US Federal Government to HHAs during CY 2021.

We’re Here to Help

Contact your Moss Adams professional for more information about this rule—including whether your county is changing status, name, or CBSA number—and possible implications for you and your organization.